Hoarding Profits by Delaying Your Recovery

After every major disaster in recent history, insurance companies have come under fire for delaying claims unnecessarily or denying valid claims. This isn't a result of incompetence or a taxing workload. This is their business model at work. In the mid-1990s, insurers discovered they could pad their quarterly earnings if they paid less than people deserved. So, settlement offers were shrunk by 30 percent or more while adjusters were trained to deny claims as often as possible.

The approach worked: Insurance companies now have the widest profit margin in the industry's history.

If your claim isn't moving quickly (or you were given a low offer), we know the tactics your insurer is using. More importantly, we know how to fight back and get the recovery you deserve for your losses.

Holding Our Local Officials Accountable for Negligence

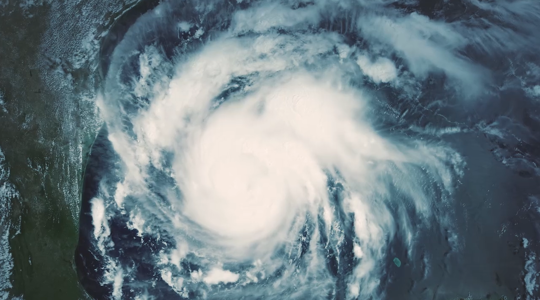

Insurers aren't the only parties to blame for the damage left behind by Hurricane Harvey.

Flood management officials in Houston, Conroe, and the region are responsible for ensuring that the flow of water through the basins of the greater Houston area cause as little damage as possible. Cities are responsible for ensuring that their residents are well-informed about the risks their communities are facing. Officials failed us on both counts during Hurricane Harvey.

For decades, engineers knew a storm like Harvey was possible and predicted the damage it would do without rebuilding infrastructure. In the 1990s, dire reports were ignored by city higher-ups, and the current flood control measures became outdated. Inaccurate FEMA maps meant home and business owners were never told they needed flood insurance, which left thousands without relief.

Have Questions About Your Hurricane Harvey Claim?

- What are my rights regarding an insurance policy?

Legally, every policyholder is entitled to specific things provided by your insurer. You are entitled to a timely and thorough investigation of your claim, and you are entitled to a good-faith payment for valid claims. You're also entitled to receive payment reasonably quickly and to know why a claim was denied if it was. Most importantly, if you believe that your claim was wrongfully denied or is being handled with deceptive or unlawful tactics, you have the right to sue the insurance company for what you need.

- Why is my claim being delayed?

In the mid-1990s, insurance companies adopted a business model called the McKinsey model. This new approach to insurance used computers to automatically offer settlements up to 30 percent smaller than what a claimant was entitled to. If clients accepted the low-ball offer, they would quickly receive a check. However, if a policyholder pushed back on the offer, the system would push the case to the bottom of a waitlist. The system was designed to put pressure on homeowners and businesses to accept low offers or risk getting no relief for months on end. This approach has earned billions of dollars for major insurance providers (built on the backs of underpaying policyholders).

- Isn't it illegal to delay my insurance claim?

The short answer is yes, it is illegal. However, insurance companies found a loophole: the law stipulates they must act on a claim within a certain window of time (usually two to four weeks). However, "acting on your claim" is too broad a phrase. Residents and businesses are reporting that insurance companies are tying up their claim in endless investigations in order to avoid paying out the claim. Some people have spent months waiting while adjuster after adjuster inspected the same damage over and over; meanwhile, these people are left without a livable home or operating business. For as long as you're not threatening legal action, insurance companies feel free to tie up your claim for months (even years).

If your claim was denied in spite of being valid, then the insurance company is playing games with you. They're betting you're more likely to give up on your claim than you are to file a civil claim. Statistically, they're right; most people give up on seeking relief rather than get help from a lawyer. However, we urge you to fight back on your recovery. The only way insurance companies are going to change their behavior is if we hold them accountable to it. More importantly, the only way you'll be able to fully recover from Hurricane Harvey and secure a financially stable future is if you fight for your claim.

Helping Houston & South Texas Get Back On Its Feet

Delayed claims aren't just an inconvenience. People are facing a years-long battle with their insurance companies to secure the right to survive. Four out of five families in the U.S. can't handle a setback larger than $2,000 for a 30-day period. Business owners, workers, and homeowners are facing six-figure and seven-figure losses from Harvey. The future of South Texas is at stake.

Our attorneys are committed to helping our clients recover:

- Business interruption costs

- Living expenses

- House repair/rebuilding costs

- Business repair/rebuilding costs

- Losses from totaled vehicles

- Household appliance costs

Insurance companies want to slow down our community's recovery. We won't let that happen.